A lack of financial resources is the foremost justification in evading an experience like the PanAm. Whether you want to travel, start a business, or buy a house, money should never be the reason not to follow through. In our case there was no inheritance, no millions made in the dot com boom, we went about it the old fashioned way. We saved our money.

Most, being accustomed to poor financial advice, will instantly conjure up methods such as skipping a morning latte, homemade haircuts, and cooking rice and beans at home in your cold, lonely basement because you can‘t afford the gas to run the heater. This is horrible advice.

Focusing on the big wins – We didn’t pinch pennies, we stuffed hundreds into the piggy bank.

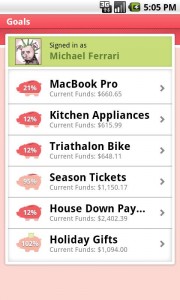

The most difficult part of running is lacing up your shoes. The same is true for saving. Sitting down and creating financial goals can seem as painful as a 26 mile marathon. Building your goal, setting a time frame, and clicking “save” is the runner’s high you didn’t expect. Setting up an automatic monthly transfer of any amount to a specific savings goal – today – is the first step and the hardest (keywords: automatic and specific). SmartyPig and ING Orange are two online savings banks that allow you to easily create specific savings goals and will automate the savings process.

Storing your savings in an account unrelated to your checking account is key. Otherwise you can tap into your savings from any number of ATMs across the country. Avoid the temptation, out of sight, out of mind Ikea.

To reach the finish line we opted against haircuts at home and a Starbucks boycott. We employed a theory of saving where the focus is big wins. We didn’t pinch pennies, we stuffed hundreds into the piggy bank. It has been proven that we have a fixed amount of willpower. Utilizing your willpower to skip the coffee shop on the way to work is a waste of resources.

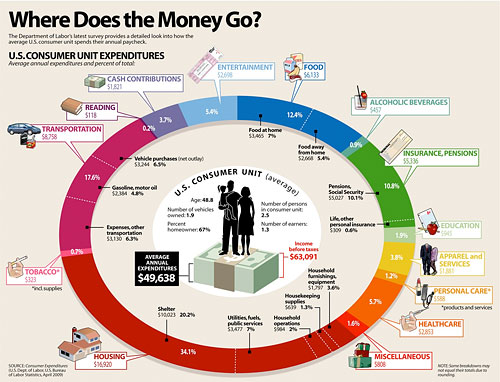

Use your financial willpower to make big cuts. We sliced our cable bill from $150/month to just $30/month. One ten minute phone call yielded an easy $2,000 win over our 16 month savings period. We examined our lease and moved five doors down on the same block and cut our monthly expenses dramatically. Within the pie, there are many slices to be cut.

Should you utilize all of your willpower on cutting down food costs when it represents less than 15% of your expenses?

We formulated a plan and set out to hit our number in 16 months. We braced ourselves for the worst, a year and a half of sacrifice and lost time, but found it never came. Not only was it easy, the entire process and transformation was half the fun. In place of constant amusement we found ourselves consciously spending and aligning priorities. This practice spilled over from our finances to all aspects of our life.

The savings lifestyle is not exclusive to globe trotters. Saving eliminates the financial excuse from doing exactly what you want to do in life. With a funded savings account your dreams become more vivid. Maybe you don’t know what you’re saving for yet but once you have the nest egg to jump off with, taking the leap is far less frightening. A friend of ours recently negotiated a remote work assignment in the city of his choice. His SmartyPig savings account gave him the wherewithal to go after what he wanted.

Further reading:

– How to Improve your Financial Willpower

– The Psychology of Automation: Building a Bulletproof Personal-Finance System

Great advice guys